16+ Iso Amt Calculator

Web We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. Web Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

![]()

Secfi Alternative Minimum Tax Calculator

Web If the calculation on Form 6251.

. Web The AMT requires taxpayers exercising an ISO to report the profit difference between the bargain price paid for a stock and the market price when its sold. AMT is designed to make sure everyone especially high. Web We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base.

Web The AMT Calculator shows how many incentive stock options ISOs you can exercise in a calendar year without paying alternative minimum tax AMT. Alternative Minimum Tax shows that your Tentative Minimum Tax is less than your regular tax you dont owe any AMT but you. Multiply whats left by the appropriate AMT tax rates.

For 2022 the threshold where the 26. Web The AMT Calculation Broadly to your regular taxable income the AMT system makes certain negative and positive adjustments such as the spread at ISO exercise and. Web Its a difficult calculation to do manually so we built an AMT Calculator to help you figure how many shares you can exercise before hitting the threshold.

Web On this page is an Incentive Stock Options or ISO calculator. Sign up to calculate AMT. You will only need to pay the greater.

Web The Carta Team. Web The worksheet contained in the Form 1040 instructions is used to determine how much AMT if any a taxpayer owes. It was designed to tax many high-income households that.

For 2020 the threshold where the 26. Web Alternative minimum tax AMT was implemented in 1969 as a parallel tax system to the current federal tax system. Web We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base.

Web Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock. The alternative minimum tax AMT is a different way of calculating your tax obligation. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your.

The Service projects that most taxpayers using the online. For 2018 the threshold where the 26. Web Once you have that AMT version of your taxable income subtract the AMT exemption amount.

Towards Laser Intensity Calibration Using High Field Ionization Springerlink

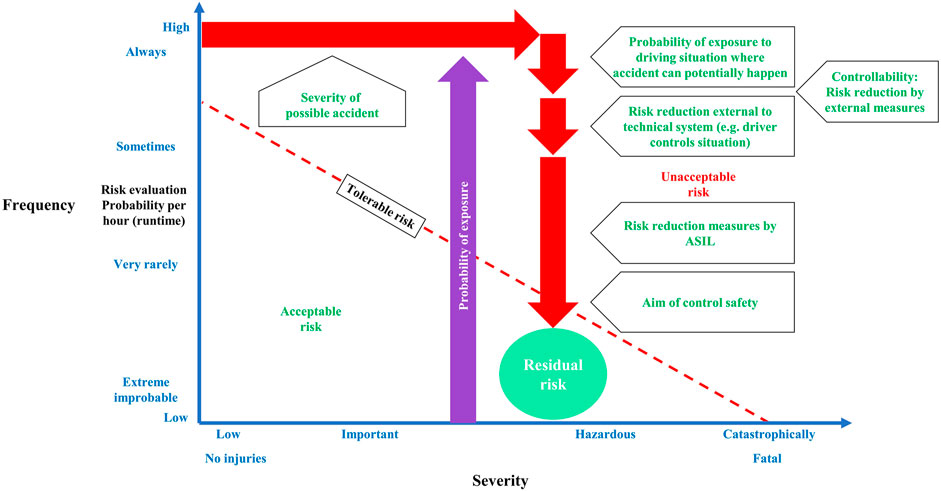

Frontiers Automotive Intelligence Embedded In Electric Connected Autonomous And Shared Vehicles Technology For Sustainable Green Mobility

Ambient Rehabilitation Kit Developing Personalized Intelligent Interior Units To Achieve Demographic Sustainability In Aging So

Table Of Lectures Society For Mycotoxin Research

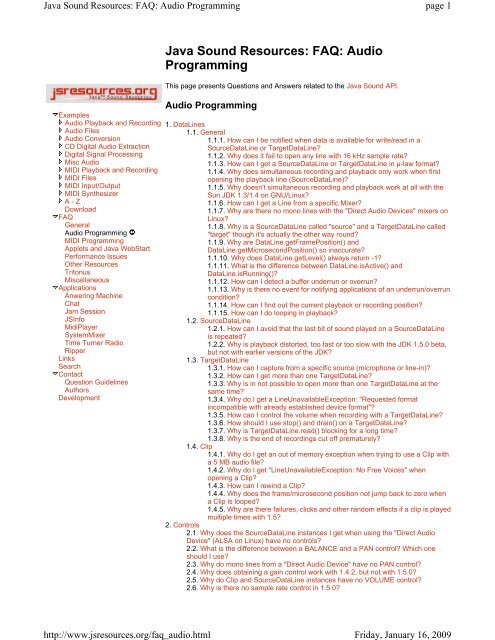

Java Sound Resources Faq Audio Programming

Omnet Simulation Manual

Pdf Studying The Impact Of Different Additives On The Properties Of Straight Run Diesel Fuels With Various Hydrocarbon Compositions

Secfi Alternative Minimum Tax Calculator

Omnet Simulation Manual

Raw Bit Depth Is About Dynamic Range Not The Number Of Colors You Get To Capture Digital Photography Review

Selective Lapsation

Pdf Collective Vibrations Built On The Kp 9 High Spin Isomer In 180ta

Eur Lex 32016r0266 Lv Eur Lex

Aptus Housing Finance Easy Emi Loan Calculator Emi Calculator

Omnet Simulation Manual

Comparing Selected Ion Collision Induced Unfolding With All Ion Unfolding Methods For Comprehensive Protein Conformational Characterization Journal Of The American Society For Mass Spectrometry

Recambios Marinos Bootszubehor Boot Motor